Supplier declarations and long-term supplier declarations make it possible to benefit from customs advantages when exporting goods. This page explains the basics of (long-term) supplier declarations in a simple and understandable way. You will also find helpful instructions on how to request a supplier’s declaration / long-term supplier’s declaration and how to issue a supplier’s declaration / long-term supplier’s declaration – including free templates to download.

Free template to request and issue (only in german)

Long-term supplier declaration template for issue

as Word and PDF versions

Long-term supplier declaration template to request

as Word and PDF versions

Introduction: Everything you need to know about (long-term) supplier declarations

What is a supplier’s declaration?

A supplier’s declaration is a declaration on the origin of a product. It identifies the described goods either

- as eligible for preference or

- as non-preferential, but a sub-step in a cumulative preferential entitlement.

On the one hand, the supplier’s declaration therefore serves as proof when applying for or issuing a preference certificate, which is a prerequisite for customs concessions for imports into third countries. On the other hand, it can also be used to apply for a certificate of origin if importing countries request one – for example for export controls. The supplier’s declaration is a document that can normally only be used in the European Union.

What is a long-term supplier’s declaration?

The long-term supplier’s declaration is a special variant of the supplier’s declaration and therefore also a declaration on the origin of goods. However, it differs from an individual supplier’s declaration in that it can be valid not only for one delivery, but for a period of up to 24 months. The main prerequisite for validity is that the same goods are delivered with the same origin. The long-term supplier’s declaration reduces administrative effort and enables predictable processes for regular supply relationships.

What exactly is the difference between a supplier’s declaration, long-term supplier’s declaration and certificate of origin?

It is not only the (long-term) supplier’s declaration that confirms the official place of origin of a product for export. Like the (long-term) supplier’s declaration, the certificate of origin is a document that serves as proof of origin in international trade. But what exactly is the difference? Who needs which document and when? Below you will find a brief explanation:

| Type of proof of origin | Meaning | Use | Issuing authority | Free of charge? | Period of validity |

| Supplier declaration | Preference-entitled or non-preference-entitled goods | A) to take advantage of customs benefits when importing into third countries OR B) to apply for a certificate of origin |

Supplier | generally yes | 1st delivery |

| Long-term supplier declaration | Preference-entitled or non-preference-entitled goods | A) to take advantage of customs benefits when importing into third countries OR B) to apply for a certificate of origin |

Supplier | generally yes | Unlimited delivery within a maximum period of 24 months (see specific details on document) |

| Certificate of origin | Non-preferential goods | For the implementation of trade policy measures by the importing country (e.g. for anti-dumping duties or controls) | IHK (in Germany) | generally no | 1st delivery |

In other words: Despite the different rules, there is still an important connection between the (long-term) supplier’s declaration and the certificate of origin. The long-term supplier’s declarations can also be used as proof of the place of origin or manufacture of the products in order to obtain the certificate of origin from your chamber of commerce!

Details on the differences

Differences in detail: 1) Form of proof and advantages for suppliers:

A (long-term) supplier’s declaration officially declares the country in which the respective product was manufactured. The countries include those with which the EU has concluded a special agreement for international trade (such as countries in the pan-Euro-Med zone): So, for example, you give preference to the import of products from a specific country (the so-called “preferential origin” or “preferential origin”). As a retailer, you use the long-term supplier’s declarations to ensure that – based on your proven originating status – discounts or exemptions apply to the goods at customs. This can give you an advantage in competition with other traders.

The certificate of origin officially declares the country in which the respective product was manufactured – just like the long-term supplier’s declaration. However, the certificate of origin does not confer any customs benefits if the supplier delivers the goods to another country. Instead, it helps the relevant customs authorities to reliably check the movement of goods.

Differences in detail: 2) Regulation and execution

The long-term supplier’s declaration is issued by different bodies than the certificate of origin: A producer based in the European Union issues a supplier’s declaration – voluntarily and without legal constraints. Meanwhile, chambers of commerce issue the certificate of origin to a supplier. Depending on the country of destination of the delivered products, there are rules as to whether such proof is necessary for you. As a rule, costs are incurred for issuing this certificate. Unlike the supplier’s declaration, suppliers do not necessarily charge you for this document.

Differences in detail: 3) Validity period

How long such a trade certificate remains valid also depends on the respective type. The validity of the certificate of origin is limited to a specific delivery and then expires. The exact opposite – as the term suggests – is the case with the long-term supplier’s declaration. It is valid for a longer period – for example one year – but for a maximum of 24 months. In addition, there are no specifications as to the maximum number of deliveries for which the long-term supplier’s declarations may provide proof of preferential origin.

What is the purpose of a (long-term) supplier’s declaration?

An supplier’s declaration or long-term supplier’s declarations erves two purposes:

Case 1: Proof of preference for tariff concessions

With a (single or long-term) supplier’s declaration, customs benefits can be used when importing goods into certain third countries. This is because the European Union has preferential agreements with many countries. Customs duties there are generally very low or even completely eliminated. However, the prerequisite for this is proof of the preferential origin of the goods – in the form of the supplier’s declaration / long-term supplier’s declarations. In this way, statements can then be made about the preferential entitlement for the products produced in-house or the merchandise.

Case 2 – in some cases: Proof of origin to apply for a certificate of origin

For some exports, third countries require a so-called certificate of origin, which the relevant Chamber of Industry and Commerce can issue to exporters based in Germany on the basis of a supplier’s declaration / long-term supplier’s declarations. The authorities in the third country then use the certificate of origin to check whether, for example, anti-dumping duties apply or further export controls are necessary.

Who issues (long-term) supplier declarations?

As the name suggests, supplier’s declarations are issued by the supplier of the goods. From a legal point of view, you are considered a supplier if you have the actual power of disposal over the goods. An long-term supplier’s declarations can normally only be issued by a supplier based within the EU for goods movements within the EU. For Swiss companies, there is a similar procedure within Switzerland with the “General Supplier Declaration” (GLE). However, these supplier declarations cannot be used for the cross-border movement of goods between Switzerland and the EU due to a lack of a legal basis.

What does a (long-term) supplier declaration contain?

A correct supplier’s declaration or long-term supplier’s declarations contains the full details of the supplier and consignee, a clear description of the goods, information on the country of origin and references to the applicable preferential arrangements. In the case of long-term supplier’s declarations, the start and end dates of validity are also included. The declaration must be drawn up in accordance with the official EU models and comply with the applicable preferential agreements. A clear assignment to the goods is crucial.

Further sources with details of the required content:

The requirements for the content that must be observed when preparing a declaration of proof with preference are described in Implementing Regulation (EU) 2015/2447 with reference to Article 64(1) of the Customs Code. The official templates can be found in Annex 22-15 (supplier’s declaration), 22-16 (long-term supplier’s declaration) as well as 22-17 and 22-18 (non-preferential origin) of this regulation. The Directorate General of Customs makes these annexes available as a 1:1 copy in three languages on its website under “Text of supplier declarations“.

How long is a supplier’s declaration or long-term supplier’s declaration valid?

A supplier’s declaration for an individual delivery is only valid for the designated consignment. A long-term supplier’s declaration must contain a clearly defined period and may be valid for a maximum of 24 months. The originating status must remain valid for the entire period. If primary materials or production processes change, the supplier is obliged to inform the recipient immediately and amend the declaration.

Since June 2017 (EU Regulation 2017/989), the following details apply to the validity period of an long-term supplier’s declarations:

- Start date and date of issue:

- The start date may not be more than 6 months after the date of issue.

- For long-term supplier’s declarations issued retroactively, the start date must not be more than 12 months before the date of issue.

- End of the validity period:

- The date must not be more than 24 months after the start date.

- Shorter validity periods are possible – in practice, they are often based on the calendar year.

What is the current legal basis for (long-term) supplier declarations?

The relevant regulations can be found here:

- in the Union Customs Code (UCC), Regulation (EU) 952/2013, in particular Art. 59-66

- in the Implementing Regulation (EU) 2015/2447, in particular in Annexes 22-15 to 22-18.

Please note: Since 2025, updates have also been made by the Implementing Regulation (EU) 2025/1728, which changes the rules of origin for trade in the pan-Euro-Mediterranean area.

For exporters: Requesting and using (long-term) supplier declarations

Who can use (long-term) supplier declarations?

Supplier’s declarations or long-term supplier’s declarations can be used by all companies that need to provide proof of origin for their export processes – for example, to validate preferential arrangements when exporting goods or to apply for a certificate of origin from the Chamber of Industry and Commerce. The documents facilitate origin verification.

For which deliveries can supplier's declaration / long-term supplier's declarations be used?

Supplier’s declaration or long-term supplier’s declarations are mainly used for intra-Community deliveries within the EU. However, supplier’s declaration / long-term supplier’s declarations can also be created and made valid for deliveries between the EU and Turkey, within the EEA (EU plus Norway, Iceland and Liechtenstein) or within the countries in the pan-Euro-Mediterranean area (PEM area) – but only with the appropriate special template in each case.

EU supplier declarations cannot be used if the supplier is based outside the EU.

When do I have to request the supplier's declaration or long-term supplier's declaration?

An supplier’s declaration or long-term supplier’s declaration should be requested before or at the latest at the start of delivery if the goods are used for export-relevant processes. Many companies regularly obtain long-term supplier’s declarations at the beginning of the year or when the supplier is created. Without valid documents, preference certificates cannot be issued correctly, which can lead to subsequent customs clearance in the importing country.

Can a supplier's declaration or long-term supplier's declaration be made valid retroactively?

Yes, under certain conditions. Single supplier declarations can be issued retrospectively, provided that the original characteristics were assured at the time. Long-term supplier’s declarations may be issued retroactively for a maximum of twelve months. The prerequisite is that the supplier can provide complete proof of origin. Individual long-term supplier’s declarations must be used for deliveries made longer ago.

How do I request a supplier declaration or long-term supplier's declaration?

Send an informal letter to the supplier with details of article numbers, original requirements and desired validity period. Use our free template (only in german), which you can easily download as a PDF or Word document.

Who is my contact person for the supplier declaration in a company?

To request a supplier’s declaration, you usually need to contact your supplier’s sales or distribution department. However, the import/export department and the accounting department – if available – can also be possible points of contact. There is no legal regulation or standard as to who within a company is responsible for issuing them.

How do I check supplier's declarations or long-term supplier's declarations that have been issued to me?

A thorough check includes formal and factual aspects. Formally, the wording of the supplier’s declaration, data details and origin information must be correct. A comparison with the customs requirements regarding the wording can be useful here. On a factual level, it is important to check whether the information on the supply chain appears plausible.

How often does a supplier's declaration or long-term supplier's declaration need to be renewed?

Single supplier declarations are only valid for a single delivery and therefore do not need to be renewed. Long-term supplier declarations must be renewed at the latest when the valid period expires. Many companies use annual long-term supplier’s declarations, even if longer periods would be possible. Premature renewal becomes necessary if the original situation or relevant regulations change.

How long do I have to keep supplier's declarations or long-term supplier's declarations?

Under customs law, proof of origin must be kept for at least three years; under tax and commercial law in Germany, it usually has to be kept for ten years.

Template and sample for requesting supplier’s declarations or long-term supplier’s declarations (only in german)

Long-term supplier declaration template for issue

as Word and PDF versions

Long-term supplier declaration template to request

as Word and PDF versions

For suppliers: Preparing and issuing (long-term) supplier declarations

Is the issuing of supplier declarations / long-term supplier's declarations mandatory?

Unless otherwise contractually agreed with the supplied customer, the preparation of a supplier’s declaration is a purely voluntary service. The preparation of a declaration cannot be enforced on any legal basis.

However, as soon as information on the origin of goods is provided, it is legally binding and should therefore be checked carefully. False statements can have consequences under civil, criminal, tax and customs law.

Under what conditions can I issue a supplier's declarations or long-term supplier's declarations?

The supplier must be able to provide reliable and documented proof of the origin of the goods. This includes production documents, pre-supplier declarations and, if applicable, certificates of origin. If reliable information is missing or if there are uncertainties regarding primary materials, no supplier’s declaration or long-term supplier’s declaration may be issued.

When is a country considered to be the country of origin?

When a country is considered to be the country of origin of products is precisely regulated. Legal texts stipulate that a product is of preferential origin as soon as it has been processed or finished to a certain degree in the specified country.

However, there is one special regulation: cumulation. Production steps in other countries are combined in order to comply with the legally prescribed degree of processing in the country of origin.

What needs to be considered when issuing (long-term) supplier declarations? / What regulations are there?

Observe the following rules when preparing and issuing supplier’s declarations / long-term supplier’s declarations:

- The wording of the supplier’s declaration / long-term supplier’s declaration is mandatory. Therefore, do not use your own wording.

- The individual goods must be clearly designated.

- The origin of the goods must be correct and verifiable.

- Long-term supplier’s declarationsrequire the specification of a concrete, valid period of validity.

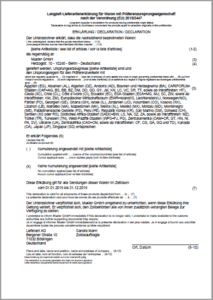

What should (long-term) supplier declarations look like?

Unlike the wording, the layout and any additions to article lists are not predefined. There is some leeway here, which is also required in practical application. We have illustrated an example here.

You are welcome to use our free templates for quick and easy document preparation. (only in german)

What must be included in (long-term) supplier declarations?

The main components are supplier and customer data, information on the origin, the preferential arrangements concerned, the exact declaration text and the list of goods. In the case of long-term supplier’s declarations, the time details are also included. Additional information such as cumulation notes must be included if they are relevant for preferential law (see next question).

What is a cumulation note?

A cumulation endorsement indicates that the customs principle of cumulation was applied in the manufacture/processing of the goods. This means that anyone supplying goods manufactured in the EC from input material originating in a country of the PanEuroMed zone without sufficient processing or treatment must cumulate in order to obtain tariff preferences for their customers in other countries of the PanEuroMed zone.

|

Accumulation does not work in the following cases: → Anyone who supplies a good that was completely extracted or produced in the EU does not cumulate. Examples are apples harvested in France, applesauce made from them in Belgium, wood from trees felled in the Czech Republic, coal mined in Spain. Anyone who supplies goods that have been sufficiently worked or processed in the EU does not cumulate either. The processing lists of the origin protocols regulate which processing is sufficient |

The note reads:

- Cumulation has been applied with …… (name of the country/countries)

- No cumulation applied”

Do I have to add the cumulation note on the supplier's declaration or long-term supplier's declaration?

The note must be added if you

- use the principle of cumulation to make the goods eligible for preferential treatment AND

- your customer wishes to export the goods to a country of the Pan-Euro-Mediterranean Agreement with customs concessions.

However, a supplier’s declaration is always valid without this endorsement.

How do I fill out a supplier's declaration / long-term supplier's declaration?

Correct completion begins with the selection of the appropriate sample. This is followed by the master data, goods description and origin details. Preference areas must be entered correctly. For long-term supplier’s declarations, the period is determined and the date of issue is added. Finally, the place, date and signature of the authorized person are entered.

Do supplier declarations have to be signed?

In principle, the supplier’s declarations or long-term supplier’s declarations must be signed and dated. Electronic signatures are permitted, provided that authenticity is guaranteed, the name of the person signing is listed transparently and there is a declaration of liability by the supplier.

What happens if I (accidentally) provide false information?

If supplier’s declarations are the cause of an incorrect origin, a tax liability arises. This is because if an EU origin is proven, the supplier’s declarations may serve the recipient as proof on the basis of which a duty-free delivery to a third country is made. In such a case, the issuer can therefore be investigated for providing false information.

→ More on the consequences of false preference statements (only in german)

Template and sample for issuing (long-term) supplier’s declarations

Long-term supplier declaration template for issue

as Word and PDF versions

Long-term supplier declaration template to request

as Word and PDF versions