What is the customs value and what is it needed for?

Anyone importing goods from a third country – i.e. a non-EU country – into the customs territory of the European Union must make a customs declaration. The customs value is very important for this. Among other things, it is used to calculate customs duties and import sales tax that are incurred when importing goods into the EU. Great care is therefore always required when calculating the customs value. The so-called transaction value is generally used to determine the value; various methods are to be used, which are specified in the “customs value scale”.

Caution: An incorrect customs value can lead to additional payments. This is because, under current law, customs may still impose consequences for an incorrect customs value in the customs declaration within three years of the import. Further customs duties, outstanding tax payments and, if applicable, interest for late payment are then often due.

Legal basis for the customs value

Important legal bases for the customs value can be found in the Union Customs Code (UCC), the customs code of the European Union. The following articles are particularly relevant:

- Article 6 of the Transitional Delegated Acts to the Union Customs Code

- Articles 69 to 76 of the Union Customs Code:

- Defines scope

- Customs valuation based on the transaction value

- Components of the transaction value

- Components not included in the customs value

- Simplification

- Subordinate methods of customs valuation

- Delegation of powers

- Delegation of implementing powers

- Articles 127 to 146 of the Union Customs Code:

- lodging of an entry summary declaration

- Risk analysis

- Amendment and invalidation of an entry summary declaration

- lodging of a customs declaration instead of an entry summary declaration

- Transfer of powers

- Transfer of implementing powers

- Notification of arrival of a seagoing vessel or aircraft

- Customs supervision

- Transport to the authorized place

- Air and maritime transport within the Union Transport under special circumstances Air and maritime transport within the Union

- Transport in special circumstances

- Delegation of implementing powers

- Presentation of goods

- Unloading and inspection of goods

- Goods in transit

- Delegation of implementing powers

- Goods placed in temporary storage

- Temporary storage declaration

- Amendment and invalidation of a temporary storage declaration

In addition to the EU legal provisions of the UCC, a national administrative regulation of the German customs administration must be observed when calculating the customs value.

Determining the customs value

Requirements for determining the customs value

It should be noted at the outset that the correct calculation of the customs value can be very complex. Many different factors play a role in determining the customs value. The problem is that information is often required that is already used in business processes during research, purchasing or sales. In order to simplify customs valuation, certain workflows must therefore be created. The required information must be forwarded automatically and in good time to the office in the company responsible for the customs declaration.

EU rules for the customs value

In order to calculate the customs value when importing goods into the EU customs territory, the regulations of the European Union must be observed. These are based on the regulations set out in the GATT (General Agreement on Tariffs and Trade) code.

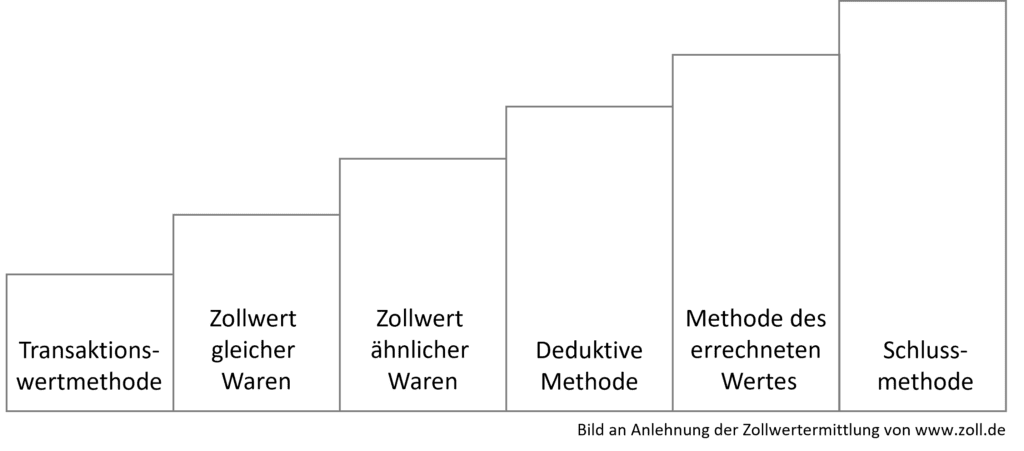

The EU rules on customs value set out a total of six methods by which the value can be calculated. However, these are not to be applied at will, but according to a fixed order – the so-called customs value scale. If the prioritized method cannot be applied, the next method must be checked for feasibility. Ideally, the value is calculated using the transaction value.

Important information for determining the customs value?

Depending on the method, different information must be used to calculate the customs value. Important information is therefore

- The amount on the invoice for the goods

- Shipping costs

- CIF value (cost of the imported goods, including insurance and transportation)

Customs value scale: Methods for determining customs value

So how should the customs value be calculated in detail? An overview of the customs value scale and the methods it defines for determining the customs value, starting with the transaction value method:

Quelle: https://www.zoll.de/DE/Unternehmen/Warenverkehr/Einfuhr-aus-einem-Nicht-EU-Staat/Zoll-und-Steuern/Normalfall-der-Verzollung/Zollwert/zollwert.html

Method 1: Transaction value

The transaction value is the most common and therefore most important way of determining the customs value. This value is based on the price of the imported goods. The value already paid or still to be paid applies.

Method 2: Transaction value of identical goods

Sometimes the first method for determining the customs value cannot be used. The reason for this may be, for example, that the import of the goods is not based on a purchase between a buyer and seller. In this case, the second method of the EU customs value scale must be used. Has the transaction value method already been used once for the same goods? Then the resulting value is also the new customs value.

Method 3: Transaction value of similar goods

The import of the goods is not based on a purchase contract with a recognizable value of the goods and the second method is also not applicable? Then the customs value must be determined on the basis of comparable goods. The price paid or transaction value of these similar goods then serves as the customs value of the new goods to be imported.

Method 4: Deductive method

If there is no invoice with a purchase price for the goods to be imported, the same goods or similar goods, the deductive method is used. The idea here is that although the value of the goods cannot yet be determined when they are actually imported, it can be determined at the latest when they are resold in the imported customs territory. The customs value is therefore calculated from the subsequent sales price minus the taxes and additional costs incurred for the goods after importation into the country.

Method 5: Calculated value

If a calculation of the value based on the deductive method fails or if the importer applies for prioritization of the sixth method over the fifth method, the customs value is added together. This includes the costs of producing the imported goods as well as possible profits and the price for transportation in the third country.

Method 6: Final method

If the customs value cannot be determined using methods one to six, this results in the so-called final method for the imported goods. In this case, the previous methods are applied with more leeway or an alternative method of calculation must be used.

Detailed information on the customs value scale and the methods for calculating the customs value can be found on the German Customs website.