Overview of the procedure for tariffing goods:

- Definition – What does tariffing mean?

- Possibilities to search the commodity tariff number: EZT-Online

- General rules in tariffing

- Structure and application of the code number

- Tariff classification of packaging and wrappings

- Explanations and notes

- Assortments of goods

- Classification of new goods

- Practical example – problem with missing information

- Binding tariff information

Definition – What does tariffing mean?

Determining the customs tariff number is essential for every customs declaration. The customs tariff number (or commodity code) is used for the following purposes:

- by the Federal Statistical Office to determine foreign trade statistics

- for the determination of import and export duties

- Excise taxes

- Export refunds

- Coding

- Approval requirements

- Additional duties

Correct customs tariff classification is also mandatory within the framework of the law on the origin of goods and preferential treatment.

Possibilities to search the commodity tariff number: EZT-Online

The official Customs website for determining the customs tariff number can be accessed at the following link: EZT Online

Other pages for determining the customs tariff number are:

General rules for tariffing

It must be possible to “tariff” every good, i.e. to find it in the (electronic) customs tariff. The rules for tariff classification are:

- In the structure of the customs tariff, raw forms always come before processed products. The rule is “purpose before substance“, i.e. the intended use is to be assessed with priority.

- A car made of metal is to be tariffed as a vehicle and not as an “other product made of metal”.

- A tariff classification under “other goods” is always to be made only after the exclusion of the preceding (sub)headings.

- A name in the tariff is preferable in the classification.

Structure and application of the code number

The subheadings of the 6-digit Harmonized System (also called HS code) apply in all member states of the World Trade Organization (WTO). The further subdivision is subject to national variations.

In principle, the customs tariff number must be indicated with 8 digits for export declarations and 11 digits for import declarations.

In the practical determination of the customs tariff number, a further distinction is made from superficial terms (chapter/item) to product-specific subtleties (subitem). Like the website zolltarifnummern.de, the electronic customs tariff offers a search function for keywords. This can be found in the electronic customs tariff under: for import/export -> classification -> keyword index

The legal regulations for the classification of goods are derived from the General Rules for the Interpretation of the Combined Nomenclature. These can be accessed under the path to import/export -> Classification -> Goods Nomenclature -> General Rules.

The following explanations are only intended to give an insight into the problems of tariffing and the search for the code number to be used and represent only a small section of the tariffing possibilities. They are intended to raise awareness of the entire subject matter, which is why some examples have been elaborated. For reasons of simplification, we will not go into special topics such as document coding, tariffing in the foodstuffs or textiles sectors here.

Tariff classification of wrappings and packagings

Packaging and containers for the transport of goods are tariffed in the same way as the goods to be declared, provided that the packaging does not constitute the actual goods. The packaging is described in more detail in the export package information (e.g. CT – carton).

Explanations and notes

Before each chapter, the notes to the chapter are to be observed, from which information can be obtained as to whether certain goods are excluded from this chapter. At the item level, further information on the HS item can be called up via the link “Explanations”, which provide specific information on the goods to be tariffed in this item.

For example, chapter 48 covers paper goods (e.g., paper stationery), but the notes to chapter 48, No. 2(p) exclude toys of chapter 95, so playing cards, such as skat cards, must be tariffed in 9504 4000 (also because they are mentioned by name)! Also in the Harmonized System (HS) Explanatory Notes to heading 9504 No. 11), “card games of all kinds […]” are mentioned by name. This example shows that a correct classification of goods in the (electronic) customs tariff is not always that easy and may require some research.

Sets of goods

Sets are classified under the heading which constitutes the principal part of the set. For example, if a hair dryer is to be sold together with chocolate, the hair dryer is the main component of the set. If, however, the hair dryer (HS heading 8516 3100) is to be sold together with a hair straightener (8516 3200) as a set (e.g., as part of a promotion), classification is to be made in the “last-mentioned heading” in accordance with General Provisions No. 3(c).

Classification of new goods

The tariff classification of new products that have been newly developed/invented and thus logically cannot be mentioned by name in the customs tariff can also be problematic. As a rule, the notes and explanations will only be of limited help here.

Here it is worthwhile to obtain a VZTA on a regular basis.

As an example, a hair remover with pulsed light is mentioned here. While electric shavers, hair clippers, clippers and epilators are tariffed under 8510 on the basis of naming, pulsed light hair removers come under 8543 7090 other machines, appliances and devices, otherwise neither named nor included.

Compare VZTA DE24125/13-1 of HZA Hannover valid until 06.07.2020

Practical example: Problem with missing information

Another problem that can arise comes into play when even different chapters come into question. This is the case, for example, with so-called VR glasses, which consist of a plastic frame, have 2 displays for each eye and are used to display three-dimensional games and movies. Possible positions here would be

- 3926 Other goods from plastic

- 9504 Video game consoles and devices […]

- 8528 Monitors and projectors

- 9004 Eyeglasses […] and similar goods

Chapter 39 can be excluded, since here the purpose use is preferable to the material requirements.

Chapter 85 cannot be excluded because the Harmonized System (HS) Explanatory Notes to Chapter 85(A)(1) and (2) do not provide for an exclusion from Chapter 85 of these VR glasses.

Chapter 95 also cannot be excluded immediately because, although it is not a video game console, parts and accessories for them may be classified here by the Harmonized System (HS) Explanatory Notes, second sentence.

HS heading 9004 covers all eyeglasses, as well as similar goods! Again, VR systems are not excluded in the Harmonized System (HS) Explanatory Notes. In paragraph 4 to the Explanatory Notes, “polarization glasses […] for viewing three-dimensional films” are assigned to this HS heading. However, this is likely to apply only to the classical 3D glasses, which have lenses with different colors or contain color-neutral filters that create a 3D effect through a corresponding technology (which is not contained in the glasses themselves).

The Harmonized System (HS) Explanatory Note to heading 9004 defines a “virtual reality (VR) headset” for connection to and use with a specific type of mobile telephone. The advice precisely defines the technical nature and that a cell phone is mandatory for putting into service.

The Harmonized System (HS) Explanatory Note to subheading 9504 50, No. 3, defines a “virtual reality headset” as follows: […] resembling goggles, contains sensors, video display modules […] and two magnifying lenses that allow the user to see a spatial view (3D view) of the video display module screen.

This example clearly illustrates the daily problems of many users in practice! Only a description of goods such as “3D headset” or “VR system” does not allow an exact tariff because the responsible person must know the exact technical specifications. In the present case, whether the 3D display takes place via a smartphone (Item 9004) or whether the headset itself displays the images (Item 9504).

Non-binding tariff information

The Customs Administration offers the possibility of obtaining non-binding tariff information. Non-binding information on the customs tariff is provided by the central information office at the General Directorate of Customs – Directorate II;

Postal address:

Generalzolldirektion

-Direktion II-

Organisation, Haushalt und Informationstechnik

Carusufer 3 – 5

01099 Dresden, GERMANY

Information for private individuals:

Tel.: +49 351/44834-510

Fax: +49 351/44834-590

E-Mail: info.privat@zoll.de

Information for companies:

Tel.: +49 351/44834-520

Fax: +49 351/44834-590

E-Mail: info.gewerblich@zoll.de

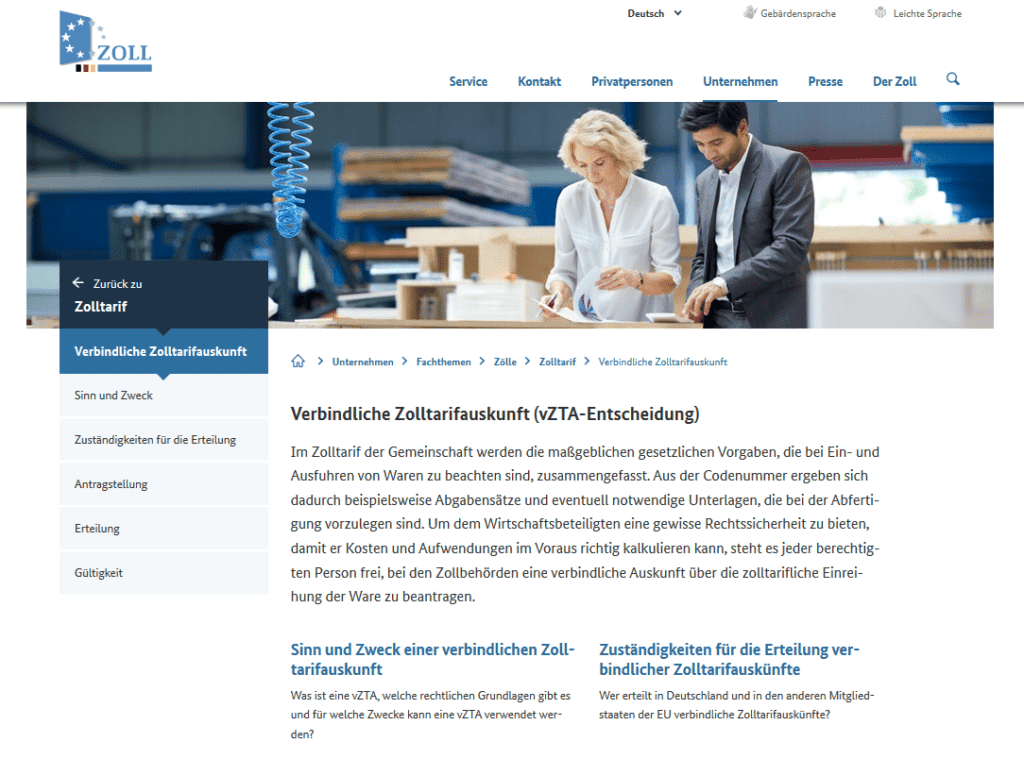

Binding tariff information

In order to obtain binding tariff information, a written application must always be submitted.

Further information and the application form can be found on the customs website:

https://www.zoll.de/DE/Fachthemen/Zoelle/Zolltarif/verbindliche-Zolltarifauskunft/verbindliche-zolltarifauskunft_node.html

We hope that this brief introduction to customs tariff classification has provided you with important assistance in determining the customs tariff number. On the one hand, it is indispensable to know the exact nature as well as the intended use exactly in order to be able to work out a correct customs tariff number. In practice, there are always differences of opinion, which can be avoided by a good research in the general regulations as well as the explanations.

Free templates and samples for LLE:

Long-term supplier declaration exhibition Template

as Word and PDF versions

Long-term supplier declaration - Request Template

as Word and PDF versions

Long-term supplier declaration-Tools:

Free templates and samples for long-term supplier declaration:

Long-term supplier declaration-Tools:

Long-term supplier declaration exhibition Template

as Word and PDF versions

Long-term supplier declaration - Request Template

as Word and PDF versions