Supplier declarations and long-term supplier declarations make it possible to benefit from customs advantages when exporting goods. This page explains the basics of (long-term) supplier declarations in a simple and understandable way. You will also find helpful...

Ressources

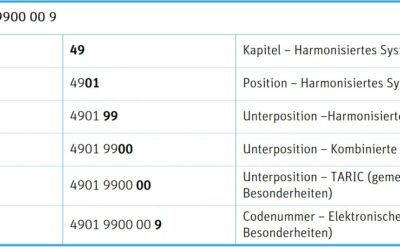

Guide to the correct procedure for the tariff classification of goods

Definition - What does tariffing mean? Determining the customs tariff number is essential for every customs declaration. The customs tariff number (or commodity code) is used for the following purposes: by the Federal Statistical Office to determine foreign trade...

Pro forma invoice from A to Z – Importance for customs and foreign trade

What is a pro forma invoice? The pro forma invoice is a document that differs from the conventional invoice primarily in that it does not request the buyer to pay. It is therefore not recorded for accounting purposes.Goods are generally subject to declaration when...

Instructions for sanctioned party list screening

Why do I need a sanctioned party lists check? Regardless of whether your company is active in import or export, the management is obliged to conduct a business partner screening. This means that it must be ensured that customers, suppliers, organizations and persons...