EU customs reform: Digital transformation of the European customs union picks up speed

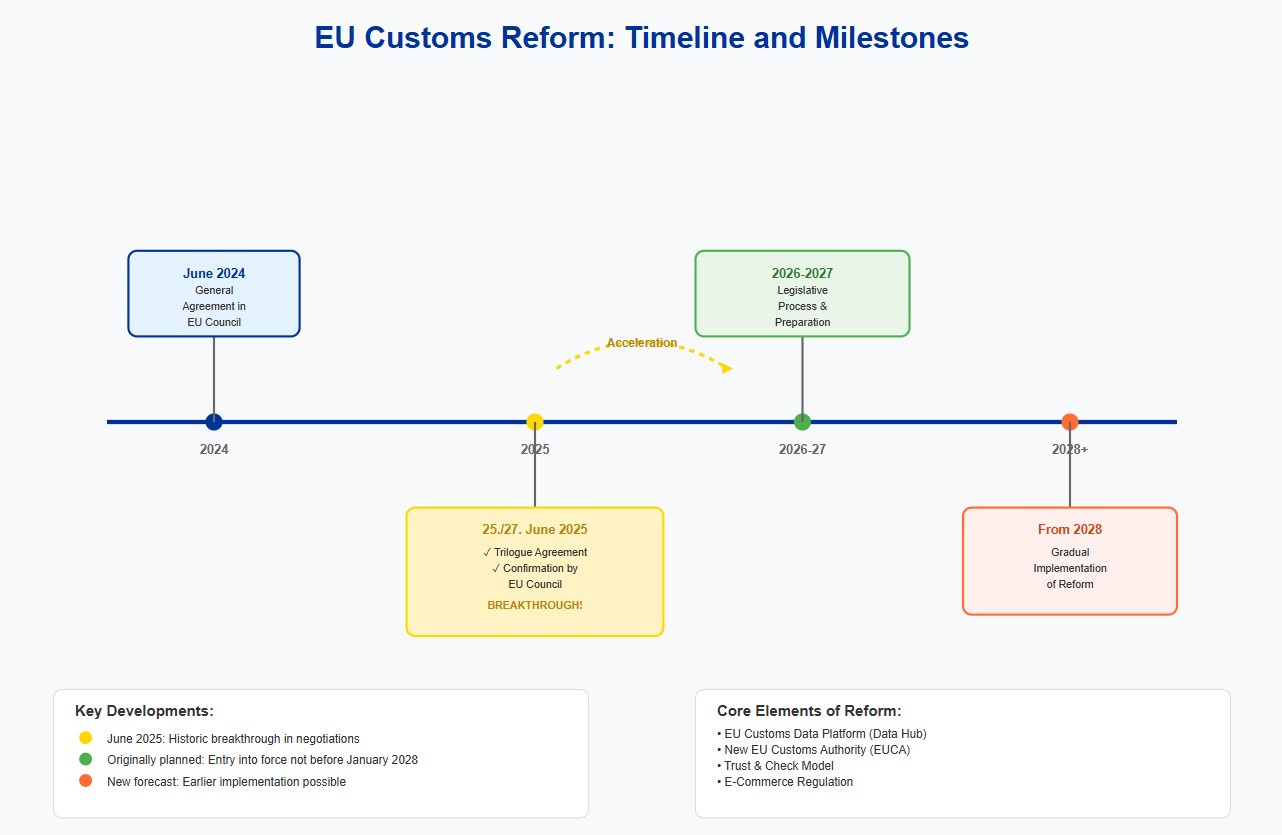

The European Union is facing the biggest reform of its customs union since it was founded in 1968. Following the agreement in principle by the EU member states in the Council at the end of June 2024, negotiations on the comprehensive modernization of the Union Customs Code (UCC) are now entering the decisive phase. The reform is intended to make the EU customs union fit for the challenges of the 21st century and increase both efficiency and security.

Breakthrough in the trilogue negotiations (June 2025)

A decisive milestone was reached on June 25, 2025: the so-called trilogue negotiations between the Council of the EU, the European Parliament and the European Commission reached a groundbreaking agreement on the EU legislative proposals for customs reform. This agreement marks the end of the intensive negotiation phase between the three EU institutions.

Confirmation by the EU Council (June 27, 2025) Just two days later, on June 27, 2025, the EU member states confirmed their common position on the reform of the EU customs union in the Council. This final position of the Council represents an important milestone in the negotiations on the new Union Customs Code (UCC) and paves the way for the implementation of the reform.

Why the reform is now unavoidable

The current structure of the EU customs union is under enormous pressure. The explosive growth in e-commerce trade, stricter regulatory requirements and changing geopolitical challenges are overburdening the existing systems. The inconsistent IT systems of the national customs authorities and the lack of central EU customs databases are particularly problematic, which encourages illegal imports and distortions of competition.

The four pillars of the reform

1. The EU customs data platform as the digital centerpiece

The centerpiece of the reform is the introduction of a central EU customs data platform (EU Customs Data Hub). This revolutionary platform will enable economic operators to provide all customs-related information via a single interface. The platform will not only replace the existing national IT systems, but will also be open to other stakeholders such as freight forwarders and warehouse operators. A particular advantage is that supply chain information can be reused for future imports and exports.

Complete digitization of customs procedures

The innovations agreed in June 2025 provide for the complete elimination of traditional customs declarations and their replacement by the digital provision of data. This will lead to a smarter, data-driven approach to import monitoring.

2. New EU customs authority (EUCA) takes over central coordination

The planned European Customs Authority (EUCA) will take over the management of the Data Hub and the associated data analysis. This new authority will carry out risk assessments and inform the Member States which high-risk goods should be stopped at the borders. Important: The Member States will retain their responsibility for customs clearance and will only be supported by the EUCA.

3. Trust & Check complements proven AEO status

Contrary to the Commission’s original plans, the tried-and-tested AEO (Authorized Economic Operator) status will be retained. The new Trust & Check model will supplement and replace the AEO status as soon as it is granted. Economic operators who have been regularly carrying out customs transactions for at least two years and meet other requirements such as financial solvency can benefit from Trust & Check status. Under certain conditions, these status holders can monitor the conformity of their goods themselves and release the goods for free circulation on behalf of the customs authorities.

4. Stricter regulation of e-commerce

The reform brings significant changes for online trade. The customs exemption for consignments of goods under EUR 150 will be abolished . In addition, a handling fee will be introduced for B2C e-commerce shipments, the revenue from which will be used to maintain the EU Customs Data Hub. This fee could be reduced to EUR 0.50 per shipment if the importer is registered with the new Trust & Check system.

Of particular significance: online platforms and traders will be treated as “deemed importers” and thus made responsible for the payment of customs duties and VAT.

Timetable and current developments

Accelerated timetable after June 2025: The successful trilogue negotiations in June 2025 have significantly accelerated the original timetable. While the reform was not originally expected to enter into force before January 2028, implementation could now take place earlier. The agreement between the Council, Parliament and Commission creates the basis for swift adoption of the final legislation.

Of particular importance for agricultural trade: The Council has adopted a partial negotiating mandate that contains important decisions for various areas of trade, in particular agricultural trade. These sector-specific regulations show the scope of the reform across all economic sectors.

Recommendations for companies

Affected economic operators should inform themselves now about current developments and set the course for future requirements at an early stage. This applies in particular to

- Online platforms and traders: Preparation for new responsibilities as “fictitious importers”

- Exporters and importers: Checking the requirements for Trust & Check status

- Logistics service providers: adapting IT systems for integration into the EU Customs Data Hub

- Agricultural traders: Special attention for the sector-specific new regulations

Die EU-Zollreform stellt einen historischen Schritt in Richtung einer digitalisierten und harmonisierten Zollunion dar, der sowohl Chancen als auch Herausforderungen für die Wirtschaft mit sich bringt. Die erfolgreichen Verhandlungen im Juni 2025 haben den Weg für eine zeitnahe Umsetzung geebnet.

Sources: