What is a personal sanctions list? Sanctions against individuals and organizations A personal sanctions list lists natural or legal persons against whom sanctions have been imposed. They therefore focus on individuals and organizations and list political measures for...

Foreign trade

Pan-Euro-Mediterranean (PEM): upcoming changes to the preferential rules of origin

At the turn of the year 2024/2025, far-reaching changes came into effect in the area of origin of goods and preferences. These require adaptations of or GENESYS software as well as the cooperation of those responsible in the companies that use this software. The...

How do I determine the customs value?

The customs value is the basis for calculating customs duties and import VAT when importing goods from third countries into the European Union. It is therefore required for the customs declaration. We show why the customs value is so important, present the legal basis...

Average storage time

Problem Companies are often faced with the question of how to provide their customers with a correct proof of origin. The key to this is preference calculation, for which not only the relevant list rules are required, but also the information as to which preferential...

HS Code 2022

What is the Harmonized System? The Harmonized System (HS) designates and codes goods and forms the basis for international trade in goods. The system is administered by the World Customs Organization (WCO) and determines the first six digits of the commodity...

Dual-use Regulation 2021/821

Dual-use Regulation 2021/821 The new EU Dual-Use Regulation was already adopted in March 2021. On May 10, 2021 the European Council also formally adopted the regulation, so that it was published in the Official Journal of the EU on June 11, 2021. 90 days later, from...

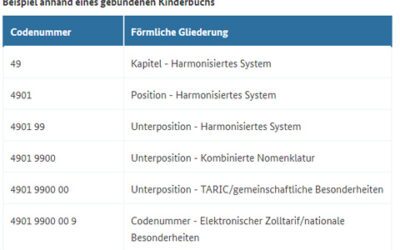

Customs tariff number, code number, commodity code, TARIC or HS code?

Customs tariff and customs tariff number - Explanation of terms The most important instrument of customs policy is the customs tariff and the customs tariff number. These are each subject to a tariff scheme. Only when the codes and numbers of the tariff schedule have...

Subsequent correction of an export declaration (nK-a)

Subsequent correction of an export declaration (nK-a) Does this sound familiar? The goods have already been handed over and an export note has been issued - but unfortunately with the wrong data? For such a case there is the possibility of subsequent correction of...

Brexit in Ireland

Brexit in Ireland: How the Brexit will affect Ireland The end of the Brexit transition phase brings huge changes for trade and border traffic and has nowhere had such a serious impact as in Ireland. At least a flare-up of the Northern Ireland conflict seems to be off...