Whether you are a financial services provider, an export-oriented SME or a large corporation, compliance with sanctions regulations is an integral part of modern compliance strategies. Automated sanctions list screening plays a central role in this. This is because violations of sanctions regulations can lead to considerable reputational and liability risks. The following article shows how state-of-the-art screening works technically – and how companies can benefit from it.

What does sanctions list screening mean – and why is it so important?

Definition: Sanctions list screening / Sanctions list check

Sanctions list screening (also known as sanctions list checking) refers to the automated comparison of internal company data (e.g. on customers, other business partners or employees) with official international sanctions lists. These lists include individuals, organisations or countries subject to economic or financial restrictions. Unlike manual checks, screening is carried out continuously using modern software solutions and with automated logging.

Current relevance of sanctions lists

Regulatory requirements are becoming stricter worldwide. EU regulations, US requirements (OFAC) and other international regulations oblige companies to carry out careful screening. Missing or incorrect checks can result not only in high fines, but also in reputational damage and operational risks.

Objective: Avoid violations of sanctions

The aim of sanctions list screening is therefore to avoid business relationships with sanctioned parties – and thereby prevent risks such as terrorist financing or violations of export controls. In this way, compliance officers create legal certainty and minimise operational uncertainties.

Who needs to screen – and in what situations?

Obligated parties

In principle, all companies operating in the EU are required to carry out sanctions checks. This is particularly relevant for:

- Exporting companies

- Banks and financial service providers

- Manufacturing companies with international connections

- HR departments for employee screening

Typical occasions

Sanctions list screenings must be carried out in the following situations, among others:

- Onboarding new customers and business partners

- Screening applicants and employees

- Domestic and international payment processing

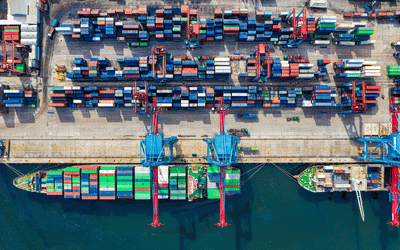

- Shipping and export processes

- Supplier evaluation

Legal framework

The basis for this is EU regulations such as Regulation (EC) No. 881/2002 (Anti-Terrorism Regulation) and the Russia-related Regulations (EU) No. 269/2014 (personal sanctions) and Regulation (EU) No. 833/2014 (economic sanctions). In addition, these regulations are regularly updated by subsequent EU sanctions packages. In Germany, the Foreign Trade and Payments Act (in particular Sections 17 and 18 AWG) and the Foreign Trade and Payments Ordinance (AWV) form the national legal framework. In Switzerland, the relevant SECO embargo regulations apply. The prohibitions on making resources available laid down in EU regulations mean that EU companies are legally prohibited from making economic resources available to sanctioned persons. This also includes the payment of salaries or social benefits. These prohibitions therefore directly affect the HR department. In certain cases, however, exemptions can be applied for from the competent national authorities, for example to cover the basic needs of sanctioned persons. When screening employees, the GDPR must be observed, which requires a legal basis for the processing of personal data and provides for transparency obligations towards the data subjects. Companies should carefully weigh up the requirements of sanctions compliance and data protection law.

Basic principle

- Identity comparison: During screening, internal data on business contacts or employees is compared with official sanctions lists. Automated verification procedures are carried out using special software solutions.

- Reporting of list hits: The software reports a hit when it detects a name match or similarity between the sanctions list and internal company data.

- Processing of list hits: Each hit must then be checked and evaluated by trained employees and, if necessary, reported to the authorities.

Matching methods

Two key methods are used:

- Exact Match: Only exact name matches result in a hit.

- Fuzzy Matching: Takes into account typos, alternative spellings (e.g. Müller / Mueller) and linguistic variants.

Hit processing

A match triggers an automatic notification. However, not every match automatically means a real risk: often these are so-called ‘false positives’ – i.e. name matches with no actual connection to the sanctioned person.

To better assess such cases, modern systems use distance functions. These calculate the similarity between a sanctions list entry and a business contact. A threshold value then determines whether the similarity is high enough to suggest a possible sanctions list hit. Every decision made when dealing with such hits should be precisely documented – an important basis for later audits. In order to individualise the hit detection despite optimal threshold and distance values based on experience and test runs, modern solutions offer experienced users the option of adjusting these values themselves.

More than just a duty: Why automated screening is the better solution

Weaknesses of manual processes

- Time-consuming: Each individual check requires manual research, which is impractical when dealing with large amounts of data.

- Prone to errors: Typos or incomplete data can easily be overlooked.

- Limited scalability: More checking means more staff – a cost factor.

- No standardised documentation: Without software, there are no audit-proof logs.

Advantages of automated solutions

- Continuous background checks: New data records can be automatically and regularly compared.

- Daily updates: All relevant sanctions lists are automatically updated.

- Notification of hits: Compliance staff can be notified immediately via notification functions.

- Logging: Each check step is fully documented – for audits and internal security.

- Scalability: Even large amounts of data can be checked easily and in a resource-efficient manner.

Integration & Processes

Modern screening solutions can be seamlessly integrated into ERP, CRM or HR systems. This enables continuous comparison instead of selective individual checks.

How SANSCREEN supports companies in the screening process

Areas of application

SANSCREEN supports companies in areas such as:

- Verification of business partners and suppliers

- Screening of applicants and employees

- Salary runs and payment runs

- Export and shipping processes

Functional advantages

- Automated comparison with EU, US, UN and CH lists (depending on the package selected)

- Daily data updates

- Automatic notification of hits

- Audit-proof logging

- SANSCREEN can be easily integrated into existing systems via interfaces

Legal security for your company - with SANSCREEN

With SANSCREEN, you can play it safe. Check your business contacts manually or automatically against daily sanctions lists. With detailed and audit-proof logs, you can provide complete proof of your compliance measures if required.

Conclusion & Recommendation

Sanctions list screening is a key component of modern compliance. Selective, manual checks are no longer sufficient. Automated processes offer greater security, reduced effort and better documentation. Our recommendation is therefore to standardise your checking processes. Use automated solutions such as SANSCREEN for continuous, legally compliant screening.