Financial sanctions have become an important instrument of international politics. They serve as an effective means of exerting pressure on states, organisations or individuals without resorting to military force. The EU sanctions list (CFSP) and other lists relevant to Germany are key elements that companies involved in foreign trade need to be aware of in order to minimise compliance risks and avoid legal consequences.

This article provides an overview of financial sanctions, their types and the reasons for their imposition. It highlights the impact on the economy and politics and explains how companies can deal with these measures. Particular attention is paid to the anti-terrorism list and its significance for global security. The aim is to provide a comprehensive understanding of this complex topic and to offer practical advice for everyday business.

Definition and types of financial sanctions

Financial sanctions are restrictions on capital and payment transactions that aim to increase pressure on sanctioned countries.

One example is the freezing of assets, which involves blocking the bank accounts and other financial resources of sanctioned individuals or organisations. Listed individuals are not allowed to be provided with any financial means or other resources.

A particularly striking example is SWIFT exclusion, which is intended to bring about a kind of ‘financial isolation’. The names of those affected are included in special annexes to the respective EU sanctions regulations.

This measure is one of the most important and serious measures in the field of economic sanctions.

Other economic sanctions include:

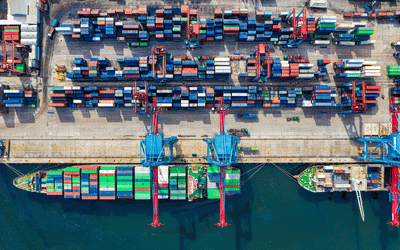

- Trade restrictions: These include export and import bans on certain goods, technologies or services.

- Travel restrictions: These include entry bans or visa restrictions on certain individuals.

- Arms embargoes: Prohibition of the sale or transfer of arms and military equipment.

- Diplomatic measures: Reduction or termination of diplomatic relations.

Reasons for imposing financial sanctions

Financial sanctions are imposed for various reasons, pursuing both political and economic objectives. One of the main reasons is to combat money laundering and terrorist financing, which pose a significant threat to the economy, the financial system and the security of EU citizens. The EU has made combating these activities a priority for over 30 years.

Another important reason for financial sanctions is to influence the behaviour of states or organisations. These measures can help bring about regime change, especially if they are multilateral and costly for the state concerned. They strengthen the negotiating power of non-violent protest movements and signal international disapproval.

Financial sanctions are also used to respond to serious political circumstances. In urgent cases, EU Member States can take unilateral measures in the area of capital and payment transactions. This flexibility makes it possible to respond quickly to changing geopolitical situations.

Impact of financial sanctions

Financial sanctions have far-reaching consequences for affected companies and individuals. They result in freezing orders that prohibit listed Russian individuals or companies from selling or encumbering their property in the EU. Access to accounts within the EU is also blocked. These measures also extend to assets controlled by sanctioned individuals or companies.

The freezing of assets refers to the blocking of bank accounts and other financial assets. Affected individuals remain the owners of the frozen assets, but are subject to strict restrictions on their use. Private use remains possible in principle, as long as no income is generated from it.

In addition to the financial consequences, sanctions can lead to a significant loss of reputation and impair access to international markets. Companies must continuously optimise their compliance strategies in order to identify and manage potential risks. The large number of sanctioned entities requires precise monitoring and adaptation of business practices in order to avoid sanctions violations and ensure smooth international business operations.

Conclusion

Financial sanctions have established themselves as an important instrument of international politics for exerting pressure on states, organizations, or individuals. They have a significant impact on the economy and the financial sector by restricting capital and payment transactions and freezing assets. It is therefore essential for companies involved in foreign trade to be familiar with and comply with the applicable regulations.

Dealing with financial sanctions requires companies to constantly adapt their business practices and compliance strategies. This is particularly true for companies involved in international trade. To avoid legal consequences and ensure smooth business operations, it is necessary to have a thorough understanding of the current sanctions regulations and to continuously monitor business relationships. In this way, companies can overcome the challenges of financial sanctions while maintaining their integrity in the global market.

FAQs

Question: What is a financial sanction?

Answer: A financial sanction usually involves freezing the assets of the persons concerned. In addition, these persons are prohibited from receiving financial funds or other economic resources unless prior authorization has been granted.

Question: What are the main types of financial sanctions?

Answer: Financial sanctions can be divided into various categories, including measures to combat terrorist financing, cyberattacks, the proliferation and use of chemical weapons, serious human rights violations, and country-specific sanctions.

Question: What does the term “funds” mean in the context of financial sanctions?

Answer: In the context of financial sanctions, the term “funds” is broadly defined and does not refer only to cash or book money. It encompasses all types of financial assets and benefits.

Question: Who is responsible for enforcing financial sanctions?

Answer: The German Federal Bank – Financial Sanctions Service Center is responsible for the administrative implementation of measures relating to funds, financial resources, and financial assistance.

List of sources:

- https://www.bundesbank.de/de/service/finanzsanktionen/finanzsanktionen-610940

- https://www.swp-berlin.org/10.18449/2024S13/

- https://www.consilium.europa.eu/de/policies/fight-against-terrorism/fight-against-terrorist-financing/

- https://www.bafin.de/DE/Aufsicht/Geldwaeschepraevention/Laender_und_Sanktionslisten/Laender_und_Sanktionslisten_node.html

- https://www.bundesbank.de/de/service/finanzsanktionen/finanzsanktionen-609138